We’ve all read the negative news about the Twin Cities housing market. Star Tribune reported that Twin Cities’ home prices have dropped accumulatively 16% over the last year.

Many people think that the reason for the price decrease is that there are more homes on the market than ever, and they are just sitting there. This isn’t true. There are actually LESS houses on the market than in the past, but the problem is that there are even less buyers .

Another big reason for the average price drop is because there has been large uptick in the number of lender-mediated homes (which include bank-owned, i.e., foreclosures, and also short sales) . Of course, this will skew the prices of the average downward.

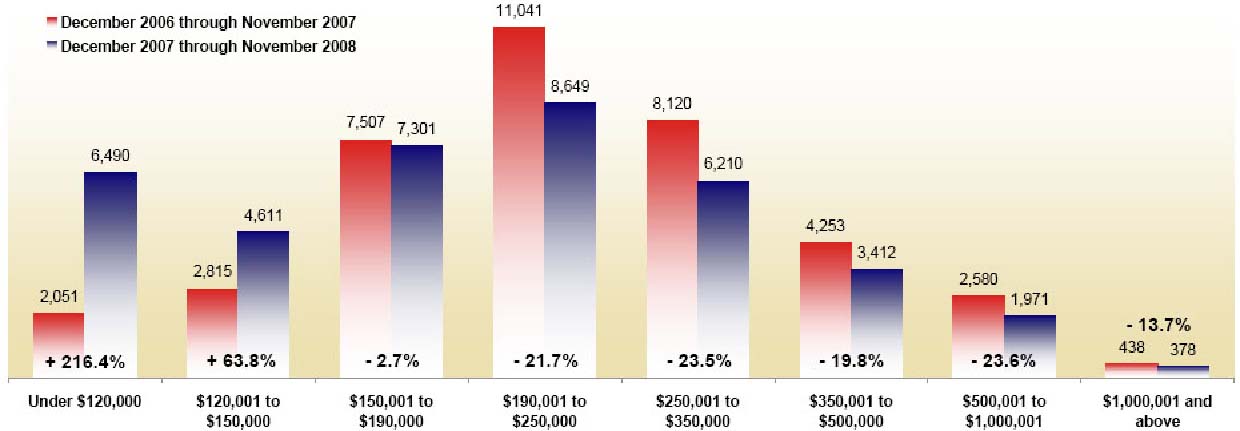

Looking at the graph above, we can see that the number of sales for homes in the under $150,000 price range more than doubled (128%) while the number of sales for houses in the $190,000 to $350,000 decreased 22%.

These numbers show that much of the decrease in selling price is attributed to the lender-mediated sales and that a house can still sell if priced right.